จาก bloomberg

Millennials Age 40 With No Home, More Debt Run Out of Time to Build Wealth

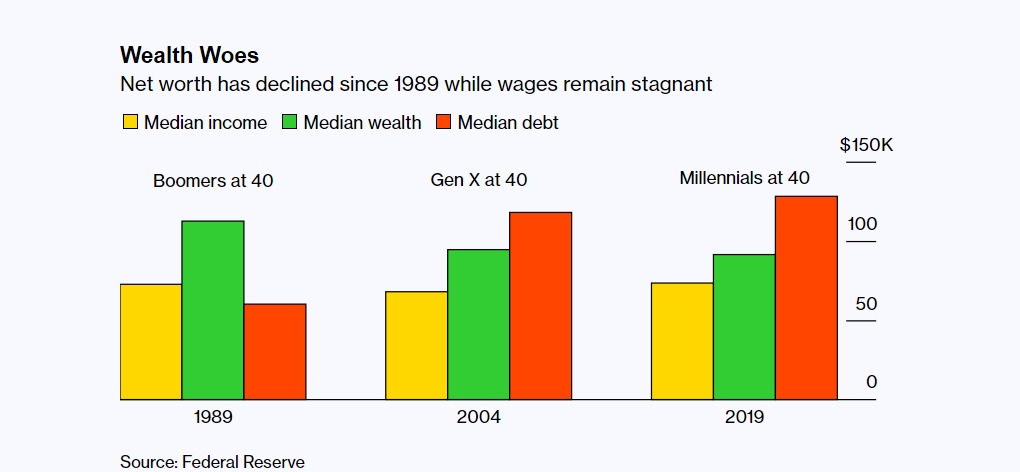

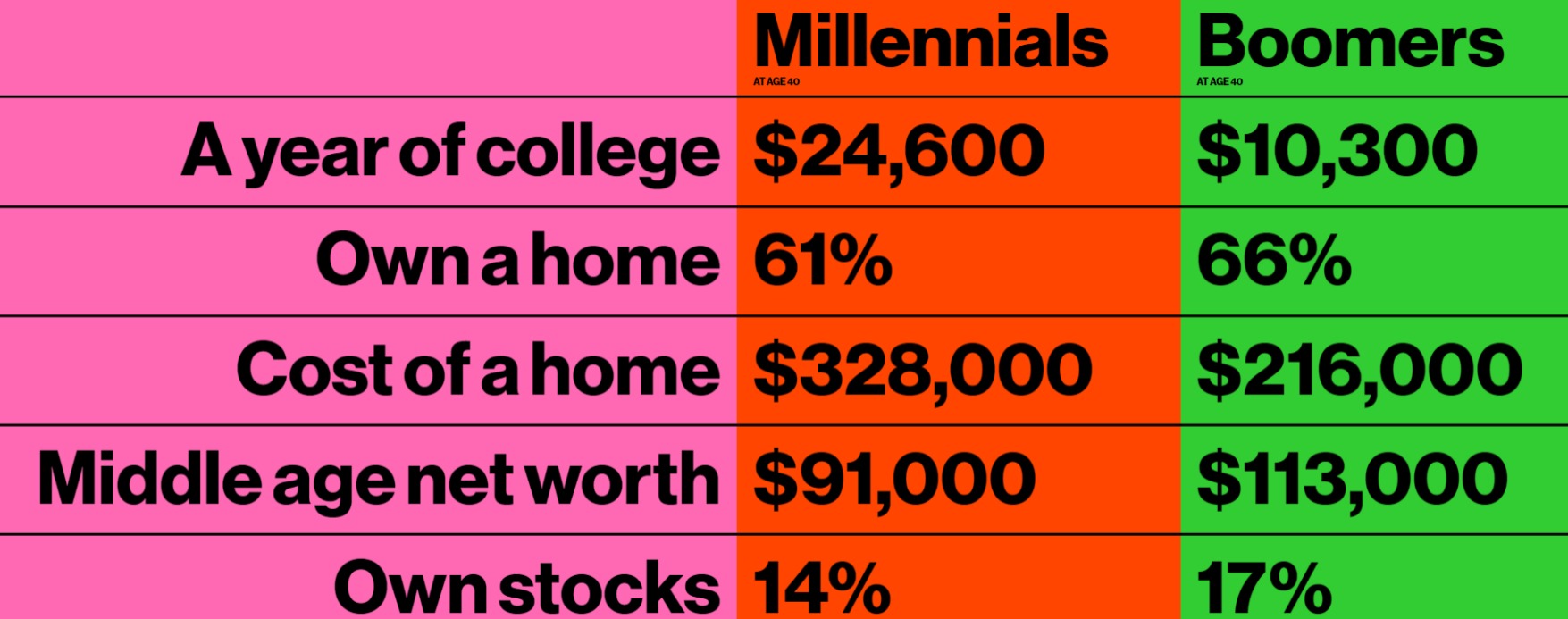

The oldest members of the generation turn 40 this year. They’re only 80% as wealthy as their parents were at this age.

In almost every way measurable, millennials in the U.S. at 40 are doing worse financially than the generations that came before them.

Fewer millennials own homes than their parents did at their age. They have more debt — especially student debt. They simply aren’t as wealthy.

Now, if predictions of a long, postCovid economic boom are to be believed, this may be the last opportunity an entire generation has to build wealth before heading off into retirement.

For Kellie Beach, a real-estate attorney who turned 40 in April, that means starting by aggressively paying down her credit-card debt. Beach has cycled between periods of carrying balances and paying it all off. “I stayed afloat with credit cards,” she said. “I was just used to swiping and overspending.”

The pandemic jolted her into taking a hard look at her habits.

“Now I have this feeling — like this fire — of urgency,” Beach said. “I’m not going to be in this place again. I can’t wait to get out of this debt. I can’t wait to save up for my emergency fund and invest again.”

£££ Gen Millennial กำลังเวลาน้อยลงเรื่อยๆ ในการสร้างความมั่งคั่ง

Millennials Age 40 With No Home, More Debt Run Out of Time to Build Wealth

The oldest members of the generation turn 40 this year. They’re only 80% as wealthy as their parents were at this age.

In almost every way measurable, millennials in the U.S. at 40 are doing worse financially than the generations that came before them.

Fewer millennials own homes than their parents did at their age. They have more debt — especially student debt. They simply aren’t as wealthy.

Now, if predictions of a long, postCovid economic boom are to be believed, this may be the last opportunity an entire generation has to build wealth before heading off into retirement.

For Kellie Beach, a real-estate attorney who turned 40 in April, that means starting by aggressively paying down her credit-card debt. Beach has cycled between periods of carrying balances and paying it all off. “I stayed afloat with credit cards,” she said. “I was just used to swiping and overspending.”

The pandemic jolted her into taking a hard look at her habits.

“Now I have this feeling — like this fire — of urgency,” Beach said. “I’m not going to be in this place again. I can’t wait to get out of this debt. I can’t wait to save up for my emergency fund and invest again.”