เมื่อวาน nvdr ขายออกอีกสามล้านกว่าหุ้น

จากการที่ ภาษีถ่านหินโดนเก็บเพิ่มอีก 6 เปอร์เซนต์ ผลประกอบการรอบนี้ กำไรน่าจะหดตัวลงอีกมาก

คิดว่า เป็นไปได้ไหม ที่หลังผลประกอบการ ที่กำลังจะประกาศ กดให้ราคาหุ้นลงถึง 20 บาท

China Coal Tariffs Add to Pressure on Producers in Australia

By James Paton Oct 10, 2014 1:01 PM GMT+0700

China, the world’s biggest coal consumer, is piling on the pain for Australian producers by ratcheting up import barriers.

China will reintroduce import tariffs in its latest effort to support money-losing domestic miners, according to a statement published yesterday on the Finance Ministry website. This follows the government’s move last month to ban the import of lower-quality coal and an announcement asking power utilities to reduce coal imports.

Australian producer New Hope Corp. plunged to a six-year low in Sydney trading, while Whitehaven Coal Ltd. (WHC) fell the most in more than two years.

“It makes Australian coal less competitive relative to China’s supply, and that’s at a time it’s already facing significant challenges, primarily due to the impact of lower prices squeezing margins,” Phillip Chippindale, a Sydney-based analyst at Wilson HTM Investment Group Ltd., said by phone.

A global glut and slowing demand growth in China have pushed prices of coal used by steelmakers to a six-year low, forcing producers from BHP Billiton Ltd. (BHP) to Glencore Plc to cut costs. Australia accounted for about 39 percent of China’s coal imports in the first eight months of this year, according to data compiled by Bloomberg.

The import tax highlights the value of the free-trade agreement with China that Australia is trying to complete in the next few months, Australian Prime Minister Tony Abbott said today during a news conference.

Tackling Pollution

“This is the kind of hiccup in our biggest and most important trading relationship that we just don’t want or need,” Abbott said. “We’ll work with the Chinese to get to the bottom of what seems to have happened.”

While the tariffs aren’t expected to affect Indonesia because of existing free-trade agreements, it probably will impact Australia and may worsen oversupply in the region, according to a Morgan Stanley report yesterday.

The Australian coal industry is seeking to reverse the tariffs as the two countries negotiate a trade agreement, the Minerals Council of Australia said in an e-mailed statement. The industry group said it’s urging the Australian government to start talks with China on the tariffs.

From Oct. 15, China will impose a levy of as much as 6 percent on coal, including 3 percent on anthracite and coking coal, according to the statement. Similar tariffs were suspended in 2007, while a tax on brown coal was resumed in August 2013.

Policy Changes

“Recent China policy changes are becoming more bearish for seaborne” coal, Daniel Morgan, a Sydney-based analyst at UBS AG, said yesterday in a report. “China’s coal policies are moving in a bid to boost profitability in the domestic industry and to tackle pollution concerns.”

The 6 percent levy on thermal coal compares with an expectation of 3 percent by UBS.

About 13 steelmaking coal mines in Australia are producing at a loss, putting them at risk of closing, though most producers, including larger ones such as BHP’s venture with Mitsubishi, are profitable, Wood Mackenzie Ltd. estimated.

More than 70 percent of China’s miners are unprofitable, and half are delaying or cutting wage payments after domestic power-station coal prices fell amid overcapacity and sluggish demand, the China Coal Industry Association said in July.

ที่มา

http://www.bloomberg.com/news/2014-10-10/china-coal-tariffs-add-to-pressure-on-australian-mining-industry.html

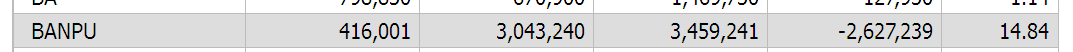

+++ Banpu บ้านปู คิดว่า จะลงถึง 20 บาท ไหม

จากการที่ ภาษีถ่านหินโดนเก็บเพิ่มอีก 6 เปอร์เซนต์ ผลประกอบการรอบนี้ กำไรน่าจะหดตัวลงอีกมาก

คิดว่า เป็นไปได้ไหม ที่หลังผลประกอบการ ที่กำลังจะประกาศ กดให้ราคาหุ้นลงถึง 20 บาท

China Coal Tariffs Add to Pressure on Producers in Australia

By James Paton Oct 10, 2014 1:01 PM GMT+0700

China, the world’s biggest coal consumer, is piling on the pain for Australian producers by ratcheting up import barriers.

China will reintroduce import tariffs in its latest effort to support money-losing domestic miners, according to a statement published yesterday on the Finance Ministry website. This follows the government’s move last month to ban the import of lower-quality coal and an announcement asking power utilities to reduce coal imports.

Australian producer New Hope Corp. plunged to a six-year low in Sydney trading, while Whitehaven Coal Ltd. (WHC) fell the most in more than two years.

“It makes Australian coal less competitive relative to China’s supply, and that’s at a time it’s already facing significant challenges, primarily due to the impact of lower prices squeezing margins,” Phillip Chippindale, a Sydney-based analyst at Wilson HTM Investment Group Ltd., said by phone.

A global glut and slowing demand growth in China have pushed prices of coal used by steelmakers to a six-year low, forcing producers from BHP Billiton Ltd. (BHP) to Glencore Plc to cut costs. Australia accounted for about 39 percent of China’s coal imports in the first eight months of this year, according to data compiled by Bloomberg.

The import tax highlights the value of the free-trade agreement with China that Australia is trying to complete in the next few months, Australian Prime Minister Tony Abbott said today during a news conference.

Tackling Pollution

“This is the kind of hiccup in our biggest and most important trading relationship that we just don’t want or need,” Abbott said. “We’ll work with the Chinese to get to the bottom of what seems to have happened.”

While the tariffs aren’t expected to affect Indonesia because of existing free-trade agreements, it probably will impact Australia and may worsen oversupply in the region, according to a Morgan Stanley report yesterday.

The Australian coal industry is seeking to reverse the tariffs as the two countries negotiate a trade agreement, the Minerals Council of Australia said in an e-mailed statement. The industry group said it’s urging the Australian government to start talks with China on the tariffs.

From Oct. 15, China will impose a levy of as much as 6 percent on coal, including 3 percent on anthracite and coking coal, according to the statement. Similar tariffs were suspended in 2007, while a tax on brown coal was resumed in August 2013.

Policy Changes

“Recent China policy changes are becoming more bearish for seaborne” coal, Daniel Morgan, a Sydney-based analyst at UBS AG, said yesterday in a report. “China’s coal policies are moving in a bid to boost profitability in the domestic industry and to tackle pollution concerns.”

The 6 percent levy on thermal coal compares with an expectation of 3 percent by UBS.

About 13 steelmaking coal mines in Australia are producing at a loss, putting them at risk of closing, though most producers, including larger ones such as BHP’s venture with Mitsubishi, are profitable, Wood Mackenzie Ltd. estimated.

More than 70 percent of China’s miners are unprofitable, and half are delaying or cutting wage payments after domestic power-station coal prices fell amid overcapacity and sluggish demand, the China Coal Industry Association said in July.

ที่มา http://www.bloomberg.com/news/2014-10-10/china-coal-tariffs-add-to-pressure-on-australian-mining-industry.html