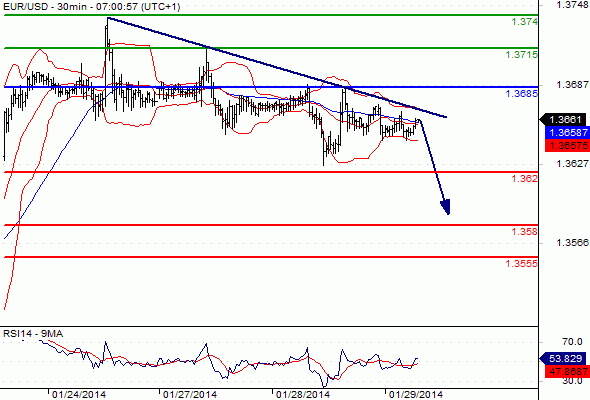

EUR/USD Intraday: capped by a negative trend line.

Pivot: 1.3685

Our preference: Short positions below 1.3685 with targets @ 1.362 & 1.358 in extension.

Alternative scenario: Above 1.3685 look for further upside with 1.3715 & 1.374 as targets.

Comment: The pair remains capped by a declining trend line.

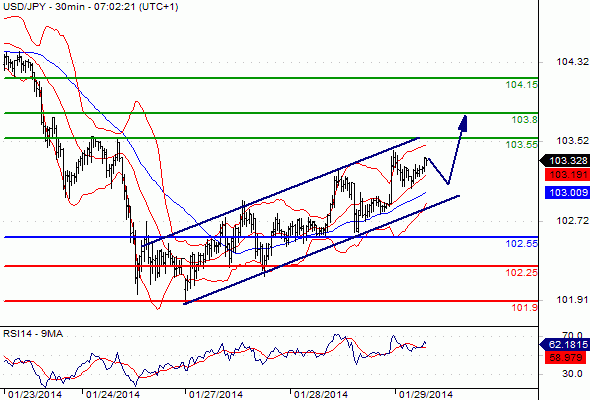

USD/JPY Intraday: the upside prevails.

USD/JPY Intraday: the upside prevails.

Pivot: 102.55

Our preference: Long positions above 102.55 with targets @ 103.55 & 103.8 in extension.

Alternative scenario: Below 102.55 look for further downside with 102.25 & 101.9 as targets.

Comment: The pair keeps trading within a bullish channel.

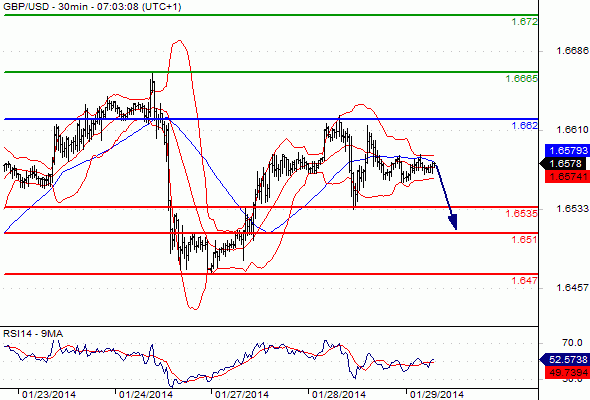

GBP/USD Intraday: under pressure.

GBP/USD Intraday: under pressure.

Pivot: 1.662

Our preference: Short positions below 1.662 with targets @ 1.6535 & 1.651 in extension.

Alternative scenario: Above 1.662 look for further upside with 1.6665 & 1.672 as targets.

Comment: as long as 1.662 is resistance, likely decline to 1.6535.

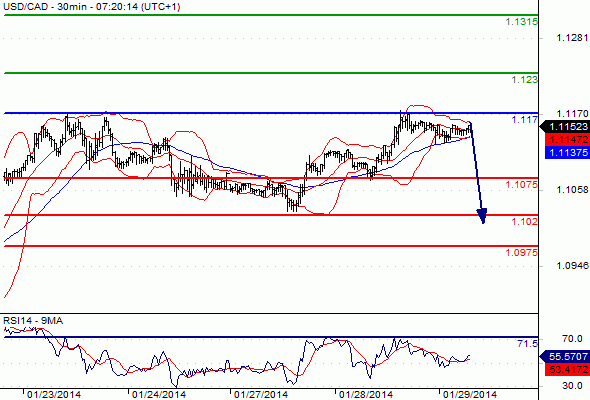

USD/CAD Intraday: key resistance at 1.117.

USD/CAD Intraday: key resistance at 1.117.

Pivot: 1.117

Our preference: Short positions below 1.117 with targets @ 1.1075 & 1.102 in extension.

Alternative scenario: Above 1.117 look for further upside with 1.123 & 1.1315 as targets.

Comment: the RSI has struck against a major resistance around 70% and is reversing down.

EUR/GBP Intraday: the downside prevails.

EUR/GBP Intraday: the downside prevails.

Pivot: 0.828

Our preference: Short positions below 0.828 with targets @ 0.822 & 0.8195 in extension.

Alternative scenario: Above 0.828 look for further upside with 0.831 & 0.834 as targets.

Comment: a break below 0.822 would trigger a drop towards 0.8195.

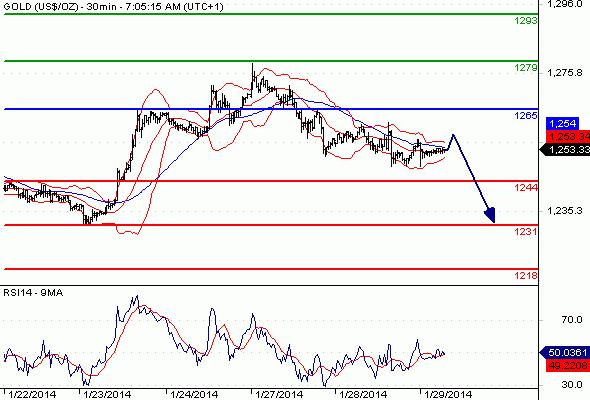

Gold spot Intraday: the downside prevails.

Gold spot Intraday: the downside prevails.

Pivot: 1265

Our preference: Short positions below 1265 with targets @ 1244 & 1231 in extension.

Alternative scenario: Above 1265 look for further upside with 1279 & 1293 as targets.

Comment: as long as 1265 is resistance, look for choppy price action with a bearish bias.

Silver spot Intraday: capped by a negative trend line.

Silver spot Intraday: capped by a negative trend line.

Pivot: 19.85

Our preference: Short positions below 19.85 with targets @ 19.3 & 19 in extension.

Alternative scenario: Above 19.85 look for further upside with 20.05 & 20.3 as targets.

Comment: the RSI is capped by a bearish trend line.

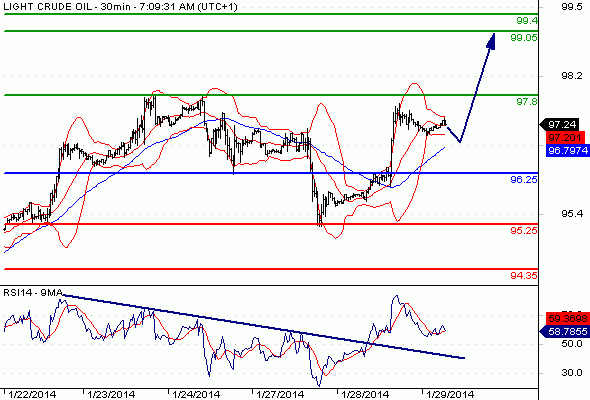

Crude Oil (NYMEX) (Mar 14) Intraday: further advance.

Crude Oil (NYMEX) (Mar 14) Intraday: further advance.

Pivot: 96.25

Our preference: Long positions above 96.25 with targets @ 97.8 & 99.05 in extension.

Alternative scenario: Below 96.25 look for further downside with 95.25 & 94.35 as targets.

Comment: the RSI broke above a declining trend line.

http://www.exnessthai.com

http://www.exnessthai.com

(Forex) วิเคราะห์ค่าเงินทางเทคนิค (ภาคบ่าย) Forex Technical Analysis: EUR/USD, USD/JPY, GBP/USD, Gold

Pivot: 1.3685

Our preference: Short positions below 1.3685 with targets @ 1.362 & 1.358 in extension.

Alternative scenario: Above 1.3685 look for further upside with 1.3715 & 1.374 as targets.

Comment: The pair remains capped by a declining trend line.

USD/JPY Intraday: the upside prevails.

Pivot: 102.55

Our preference: Long positions above 102.55 with targets @ 103.55 & 103.8 in extension.

Alternative scenario: Below 102.55 look for further downside with 102.25 & 101.9 as targets.

Comment: The pair keeps trading within a bullish channel.

GBP/USD Intraday: under pressure.

Pivot: 1.662

Our preference: Short positions below 1.662 with targets @ 1.6535 & 1.651 in extension.

Alternative scenario: Above 1.662 look for further upside with 1.6665 & 1.672 as targets.

Comment: as long as 1.662 is resistance, likely decline to 1.6535.

USD/CAD Intraday: key resistance at 1.117.

Pivot: 1.117

Our preference: Short positions below 1.117 with targets @ 1.1075 & 1.102 in extension.

Alternative scenario: Above 1.117 look for further upside with 1.123 & 1.1315 as targets.

Comment: the RSI has struck against a major resistance around 70% and is reversing down.

EUR/GBP Intraday: the downside prevails.

Pivot: 0.828

Our preference: Short positions below 0.828 with targets @ 0.822 & 0.8195 in extension.

Alternative scenario: Above 0.828 look for further upside with 0.831 & 0.834 as targets.

Comment: a break below 0.822 would trigger a drop towards 0.8195.

Gold spot Intraday: the downside prevails.

Pivot: 1265

Our preference: Short positions below 1265 with targets @ 1244 & 1231 in extension.

Alternative scenario: Above 1265 look for further upside with 1279 & 1293 as targets.

Comment: as long as 1265 is resistance, look for choppy price action with a bearish bias.

Silver spot Intraday: capped by a negative trend line.

Pivot: 19.85

Our preference: Short positions below 19.85 with targets @ 19.3 & 19 in extension.

Alternative scenario: Above 19.85 look for further upside with 20.05 & 20.3 as targets.

Comment: the RSI is capped by a bearish trend line.

Crude Oil (NYMEX) (Mar 14) Intraday: further advance.

Pivot: 96.25

Our preference: Long positions above 96.25 with targets @ 97.8 & 99.05 in extension.

Alternative scenario: Below 96.25 look for further downside with 95.25 & 94.35 as targets.

Comment: the RSI broke above a declining trend line.

http://www.exnessthai.com